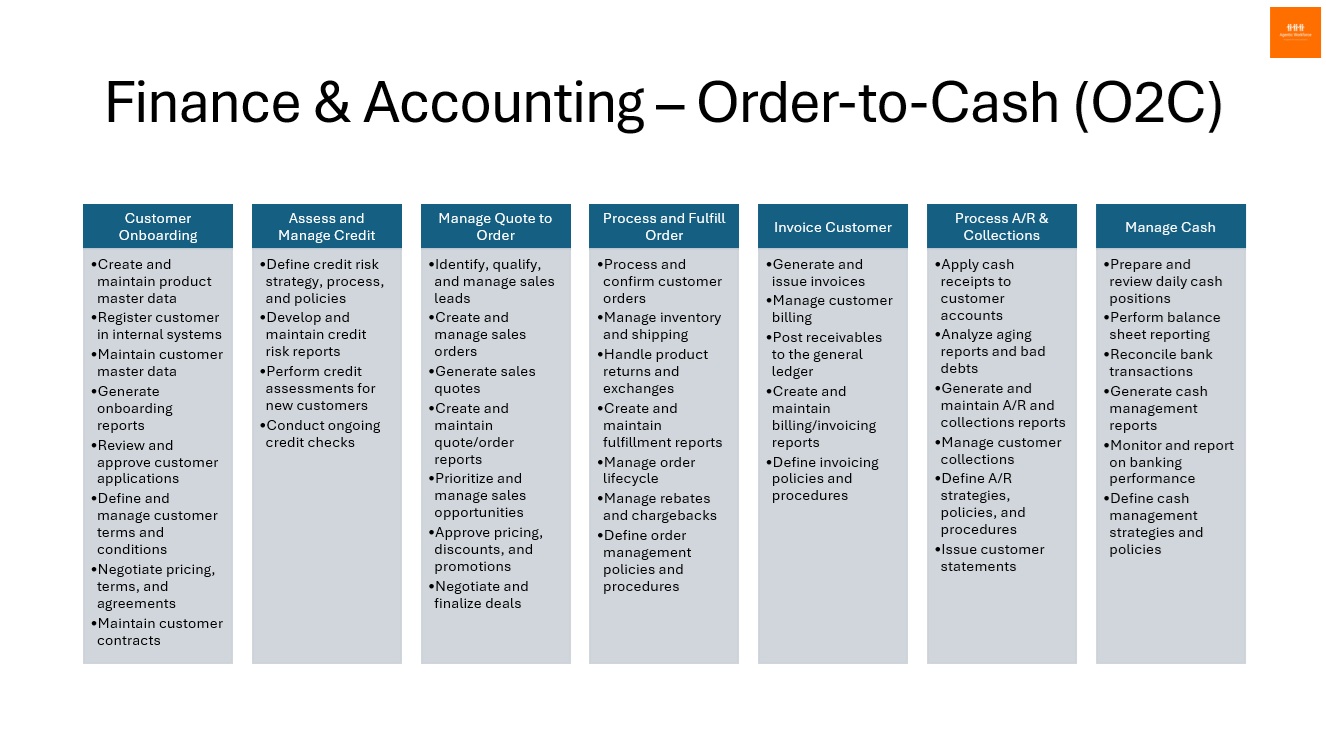

AI agents are reshaping the way modern enterprises run their finance & accounting operations. From handling customer orders to reconciling payments, AI agents are no longer just about boosting employee productivity—they're now driving real business outcomes in the Order-to-Cash (O2C) process.

Here are 6 high-impact AI agent use cases delivering measurable results:

✅ Manage and maintain customer contracts — Monitor terms, trigger renewals, and flag discrepancies

→ Reduce revenue leakage and improve contract compliance.

See AI Agent for Vendor Onboarding

✅ Perform credit assessments for new customers — Analyze creditworthiness in real time using multi-source data

→ Speed up onboarding while minimizing risk exposure.

✅ Process and confirm customer orders — Validate orders, check inventory and pricing, and send confirmations instantly

→ Increase order accuracy and shorten fulfillment cycles.

See AI Agent for Sales Order Intake

✅ Manage inventory and shipping — Forecast demand, optimize stock, and coordinate logistics

→ Lower stockouts and reduce carrying costs.

See AI Agent for Demand Forecasting

✅ Apply cash receipts to outstanding invoices — Auto-reconcile payments—even without full remittance info

→ Accelerate cash application and enhance cash visibility.

See AI Agent for Remittance Matching

✅ Manage customer collections — Prioritize outreach, automate follow-ups, escalate intelligently

→ Improve DSO and boost working capital.

See AI Agent for A/R Collections

The future of O2C is autonomous, intelligent, and value-driven. Is your business ready?

#AIAgents #AgenticAI #OrderToCash #FinanceAutomation #DigitalTransformation #CashFlow #ARAutomation

Top AI Agent Use Cases in the O2C Process