Key Takeaways

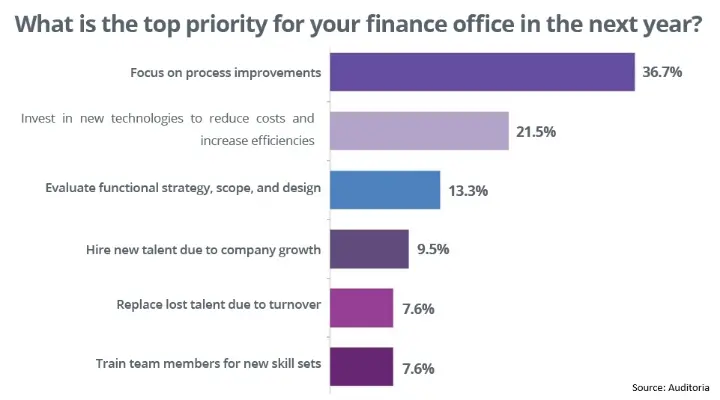

📊 36.7% of finance teams now rank process improvement as their top priority, i.e. standardize first, automate second.

🤖 Generative AI and autonomous agents are now the top two tech trends, overtaking traditional AI and RPA.

📬 Data extraction from unstructured documents remains the #1 challenge at 19.5%, signaling ongoing struggles with data deluge.

The 2025 Auditoria “State of AI Automation in the Finance Office” report paints a fascinating picture of a profession in flux.

Finance is no longer about ledgers — it’s about leverage. Yet the modern “scribe” still spends hours chasing emails and extracting data from PDFs. Data extraction remains the #1 pain point (19.5%), unchanged for three years.

Even as automation adoption hits 47.5%, fewer than 1 in 10 finance teams have advanced beyond basic workflows. Meanwhile, Generative AI (25.9%) and autonomous agents (16.5%) have surged ahead, while RPA has collapsed to just 1.5% — a clear signal that the old automation paradigm is giving way to intelligent, autonomous AI agents.

In short: finance isn’t short of tools; it’s short of time. Coordination now drains more resources than analysis or strategy — proof that the next wave of transformation isn’t about speed, but orchestration.

As the report aptly puts it: “We’ve automated the ledger, but not the letter.”

🧭 The finance renaissance won’t come from adding more bots. Rather, true transformation will come from deploying AI agents that think, plan, and act across fragmented workflows and complex scenarios. The future of finance belongs to those who turn automation into autonomy.

#FinanceTransformation #AIAutomation #CFO #AgenticAI #DigitalFinance #IntelligentAutomation #FinanceLeadership #FutureOfWork #AIAgents

What is the state of AI Automation in Finance and Accounting?